2022 ACEC/MD LEGISLATIVE REPORT

2022 Legislative Summary – downloadable PDF version

The 2022 Session of the Maryland General Assembly was eventful and even exciting for those who follow these things closely. That is not to say that everyone was pleased with the outcome.

For several years, the Legislative Committee of ACEC/MD has been actively pursuing the passage of legislation that would make a contract clause that requires an engineering firm to assume uninsurable liability for indemnity and defense costs for a claim where they are not the proximate cause of the loss or injury, void and unenforceable.

We held meetings with the members of the House and Senate Committees, drafted legislation that had passed successfully in other states and with the excellent sponsors, prepared testimony and witnesses to testify at the hearings, gathered support from other organizations so we had hopes that this would be the year that the bill would pass.

The Senate Bill 161 was sponsored by Senator Chris West and passed the Senate Judicial proceedings and the full Senate unanimously. The House Bill 79 was sponsored by Delegate Jon Cardin, who was chair of the Judiciary Committee’s Subcommittee on Civil Law and Proceedings, and co-sponsored by Ways and Means Committee Chair, Vanessa Atterbeary, former Vice Chair of the Judiciary Committee. So, you would think it would have a good chance of passing the House Judiciary Committee?

The problem we could not surmount was the opposition of the Office of the Attorney General (OAG) which submitted letters of opposition for the last three years.

ACEC/MD has met with the (OAG) and Attorney General Brian Frosh on one occasion. We offered to make significant amendment to the bill to alleviate the objections of the OAG, but it turned out the OAG’s objections were immutable, and Judiciary Committee Chair would not allow either HB 79 or SB 161 to be voted if the OAG opposed the bills.

This is an election year and there will be a new Governor, new Attorney General next year and as many as 1/3 of the members of the Maryland General Assembly will change as well. ACEC/MD is starting now to prepare for the next session by planning to meet with the candidates for Attorney General and identify those incumbents we want to meet with prior to the July Primary, the Primary winners we need to meet with prior to the election in November and the election winners we want to meet prior to the next General Assembly.

Below is the report on the legislation that the ACEC/MD Legislative Committee reviewed during the 2022 Maryland General Assembly.

TRANSPORTATION

The Budget

House Bill 1187 Transportation – Highway User Revenues – Revenue and Distribution (PASSED) increases the amount of funds from the Gasoline and Motor Vehicle Revenue Account (GMVRA) that the Maryland Department of Transportation (MDOT) must annually provide to local governments beginning in fiscal 2024. Additionally, also beginning in fiscal 2024, the bill increases (1) the portion of the corporate income tax revenue that must be distributed to a special fund for distribution to GMVRA and an administrative cost account within the Comptroller’s Office; and (2) the portion of that special fund that must be distributed to the administrative cost account. Under the bill, general fund revenues decrease by $52 million in fiscal 2024, $73 million in fiscal 2025, $97 million in fiscal 2026, and $104 million in fiscal 2027.

| DISTRIBUTION OF HIGHWAY USER REVENUES | |||

| FY 24 | FY 25 | FY 26 | |

| MDOT | 84.4% | 82.0% | 80.0% |

| 9.5% | 9.5% | 11.0% | 12.2% |

| Counties | 3.7% | 4.3% | 4.8% |

| Municipalities | 2.4% | 2.7% | 3.0% |

The General Assembly passed a fiscal 2023 capital program totaling $7.760 billion, including $2.567 billion for the transportation program through the Consolidated Transportation Program (CTP). Apart from the CTP, the program totals $5.192 billion: $1.219 billion is funded with general obligation (GO) bonds authorized in Senate Bill 291.

Transportation Legislation ACEC/MD SUPPORTED that PASSED:

SB 514 & HB 778 Transportation – Investment Program – MARC Rail Service (Maryland Regional Rail Transformation Act) (PASSED) requires the MTA to establish individual investment programs to advance the Maryland Area Regional Commuter (MARC) Cornerstone Plan and other MARC improvements in two ways: (1) advance specified rail priority projects as part of the investment programs; and (2) conduct a MARC Cornerstone Plan Implementation Study. In Fiscal Year 2023, MTA shall advance the following rail priority projects: (1) in coordination with the District of Columbia, Virginia, the VRE, Amtrak, and CSX, develop a service and operations plan for MARC through–running to Alexandria, Virginia; (2) in coordination with Delaware, Pennsylvania, the SEPTA, and Amtrak, develop a service and operations plan for MARC, SEPTA, or Amtrak to run competitive transit schedules between Perryville, Maryland and Newark, Delaware; (3) complete 30% of the design for a new Elkton infill MARC station on the Penn line; (4) complete 30% of the design for a new Bayview infill MARC station on the Penn line; (5) complete 30% of the design for: (i) a third track between Rockville and Germantown on the Brunswick line to better serve western Maryland and existing communities served by the line; and Germantown station improvements; and (6) complete 15% of the design for a fourth track on the Penn line. In addition, the bill establishes a Transportation Trust Fund (TTF) Workgroup to examine specified funding issues. The workgroup must be staffed by the Department of Legislative Services (DLS) and submit a report of its findings and recommendations to the Governor and the General Assembly by December 16, 2022.

Transportation Legislation ACEC/MD OPPOSED that PASSED:

SB 520 & HB 433 Motor Vehicles – Speed Limits – Establishment and Enforcement authorizes (PASSED) Baltimore City to decrease, or increase to a previously established level, the maximum speed limit on a highway under its jurisdiction without performing an engineering and traffic investigation. The bill also prohibits a local jurisdiction from using a speed monitoring system (i.e., speed camera) to enforce speed limits on any portion of a highway for which the speed limit has been decreased without performing an engineering and traffic investigation. ACEC/MD opposed this bill because it allows Baltimore City to alter the speed for traveling on any highway under its jurisdiction without performing an engineering or traffic study. Currently, in Baltimore City and the other 23 jurisdictions, State and local governments can change speed limits on highways under their respective jurisdiction only after completing an engineering or traffic study that conforms with the Manual on Uniform Traffic Control Devices (MUTCD).

Transportation Legislation ACEC/MD OPPOSED that FAILED:

SB 337 & HB 144 Motor Fuel Tax Rates – Consumer Price Index Adjustment – Repeal (FAILED) would have repealed the annual indexing to inflation of specified motor fuel tax rates. Under current law, motor fuel taxes are increased annually based on inflation, as measured by the Consumer Price Index (CPI). The bill would have repealed any future increases beginning in fiscal 2023.

SB 737 & HB 1191 Cost of Living Assistance Act of 2022 (FAILED) would have temporarily repealed (fiscal 2023 and 2024) the annual indexing to inflation of specified motor fuel tax rates. Under current law, motor fuel taxes are increased annually based on inflation, as measured by the Consumer Price Index (CPI).

Transportation Legislation ACEC/MD MONITORED that PASSED:

HB 73 Baltimore City – Complete Streets and Safe Routes to School Programs – Funding (PASSED) expressly authorizes Baltimore City to use any fines collected by Baltimore City as a result of violations from specified automated enforcement systems to be used to administer the systems. Any remaining funds must be used for (1) infrastructure and non-infrastructure activities eligible for funding under the State Highway Administration (SHA) Safe Routes to School Program, as specified and (2) public safety or transportation infrastructure improvements consistent with the purpose and goals of the State Complete Streets Program and the city’s Complete Streets Transportation System. ACEC/MD shares a concern that was expressed by the Baltimore City Comptroller, that the bill could be interpreted to allow this revenue to be used for purposes other than infrastructure and other capital improvements, whether they are transportation-related or public safety-related.

HB 133 Environment – Sealant Products – Prohibitions (Safer Sealant Act of 2022) (PASSED) prohibits, beginning October 1, 2023, the sale and use of “high-PAH sealant products” that are applied to driveways and parking areas. Airports, federal facilities, and military facilities are exempt from the bill’s provisions. Existing and new enforcement and penalty provisions apply to the bill and any related regulations or orders. Penalties are paid into the Maryland Clean Water Fund, and MDE is authorized to use the fund to implement the bill. MDE is also authorized to adopt implementing regulations. Finally, the bill establishes provisions related to the authority of local governments to establish related standards or requirements.

SB 593 & HB 891 Department of Transportation and Spending Affordability Committee – Reports (PASSED) requires the MDOT to report to specified committees of the General Assembly on estimated costs related to projects for which planning funds were added to the budget by the General Assembly, as specified; (2) requires MDOT to include specified information in the Consolidated Transportation Program (CTP) related to projects receiving construction or planning funds for the first time; (3) alters the date by which the Spending Affordability Committee (SAC) must submit its annual report; and (4) expands the information that must be included in the SAC report.

HB 632 Baltimore East–West Corridor – Transit Study – Requirements (PASSED) establishes project planning requirements, contingent on the receipt of federal funds, for the MDOT for the “Red Line” and the MARC rail extension to the Johns Hopkins Medical Center. For fiscal 2024 through 2027, the Governor must include in the annual budget bill an appropriation from the Transportation Trust Fund (TTF) of at least $5.0 million, contingent on the receipt of federal funds to be used to provide matching funds needed to conduct an environmental impact study under NEPA for the two projects. Also, for fiscal 2024 and each fiscal year thereafter, and contingent on the receipt of federal matching funds, the Governor must include in the annual budget bill an appropriation from TTF of $200,000 to the Baltimore City Mayor’s Office of Employment Development for Workforce Development and Small, Minority, and Women-Owned Business Development.

HB 656 Safe Access for All (SAFE) Roads Act of 2022 (PASSED) requires the MDOT to recommend and implement certain design elements related to pedestrian and bicycle safety when developing certain projects; requiring the Governor, for fiscal year 2024, to include an appropriation in the annual budget bill at least as follows ADA Retrofit – $7,400,000; Bicycle Retrofit – $6,200,000; Safety and Spot Improvements – $44,100,000; Sidewalk Program – $8,500,000; Traffic Management – $39,100,000, and increase appropriations for certain purposes; providing that it is the intent of the General Assembly that the MDOT maximize applications for and access to federal funding that is or may become available for infrastructure for pedestrian and bicycle safety; etc. Requires SHA report the number of open positions and to the extent these open positions slow down the process of implementing safety improvements once improvements have been identified, and information about employees that perform direct labor on highway and road safety improvement projects for SHA.

SB 874 & HB 254 State Highway Administration – Pedestrian and Bicyclist Fatalities – Infrastructure Review (Vision Zero Implementation Act of 2022) (PASSED) This bill requires the SHA to conduct an infrastructure review of each pedestrian or bicyclist fatality that occurs on a State highway or at an intersection of a State highway and another highway or municipal street. The bill establishes requirements for SHA in conducting the infrastructure reviews and requires that each review be (1) completed within six months after SHA is notified by law enforcement of a fatality and (2) published on SHA’s website. By December 1, 2023, SHA must publish the vulnerable road user safety assessment required by the federal Infrastructure Investment and Jobs Act (IIJA) on its website. MDOT responded that much of what this bill requests has been done and is being provided by the various agencies in the Department.

SB 1010 Motor Fuel Taxes – Tax-Free Period (PASSED) This emergency bill temporarily eliminated certain motor fuel taxes during a 30-day period beginning on March 18, 2022. As of July 1, 2021, the per gallon motor fuel tax rate is equal to 36.1 cents (gasoline and clean-burning fuel), 36.85 cents (special fuel/diesel), and 7.0 cents (aviation and turbine fuel). After distribution to an administrative cost account, net motor fuel taxes are distributed to the TTF, Chesapeake and Atlantic Coastal Bays 2010 Trust fund (2010 Trust Fund), and Waterway Improvement Fund. A portion of TTF revenues is used to provide capital transportation grants to local governments. Special fund revenues decrease by $93.6 million in FY 2022 due to a reduction in motor fuel tax revenues. Supplemental Budget No. 2 provides $100.0 million in general fund revenues to offset the loss in special funds resulting from the bill. The tax was reinstated on April 17, 2022.

HB 1336 Greater Baltimore Transit Governance and Funding Commission (PASSED) establishes the Greater Baltimore Transit Governance and Funding Commission to study, review, and make recommendations on specified issues related to transit governance and funding for the Baltimore area transit system. The commission must be staffed by the Baltimore Metropolitan Council (BMC). The commission must submit an interim report of its findings and recommendations to the Governor and the General Assembly; by December 1, 2022, a final report is due by December 1, 2023.

Transportation Legislation ACEC/MD MONITORED that FAILED:

SB 23 &HB 141 Equity in Transportation Sector – Guidelines and Analyses (FAILED) would have required the MDOT beginning July 1, 2023, in collaboration with the MTA, to conduct a transit equity analysis, perform a cost-benefit analysis, consult with members and leaders of affected communities, and take specified actions based on the results of these activities before announcing (1) any service change that would constitute a major service change under specified federal guidelines or (2) any reduction or cancellation of a capital expansion project in the construction program of the Consolidated Transportation Program (CTP) that exceeds transit equity thresholds developed by MTA pursuant to the bill. The bill also would have expanded existing transportation plans, reports, and committees to include transportation equity issues.

HB 120 Railroad Companies – Condemnation Authority – Application (FAILED) would have specified that the general authority of a railroad company to acquire property by condemnation would not apply to an entity that owns or operates a railroad powered by a magnetic levitation propulsion system.

SB 359 & HB 326 State Finance – Prohibited Appropriations – Magnetic Levitation Transportation System (FAILED) would have prohibited the State (or any unit or instrumentality of the State) from using any appropriation for a magnetic levitation (Maglev) transportation system located or to be in the State. The bill did not apply to expenditures for the salaries of personnel assigned to review permits or other forms of approval for a Maglev transportation system.

HB 404 Vehicle Laws – Speed Limits – Establishment (FAILED) would have authorized local authorities (statewide) to decrease the maximum speed limit to no less than 15 miles per hour (MPH) on a highway but only after performing an engineering and traffic investigation. However, a locality would have been prohibited from implementing a new speed monitoring (i.e., speed camera) system to enforce speed limits on any portion of a highway for which the speed limit has been decreased to less than 25 MPH pursuant to this authorization.

SB 584 & HB 1024 Task Force on Traffic Patterns and Infrastructure on MD 45 (York Road) (FAILED) would have established the Task Force on Traffic Patterns and Infrastructure on MD 45 (York Road) to study and make recommendations on specified traffic, parking, usage, and signage issues on the road. The State Highway Administration (SHA) would have been required to provide staff for the task force. The task force would have been required to report its findings and recommendations to specified committees of the General Assembly by December 31, 2023.

HB 656 Safe Access for All (SAFE) Roads Act of 2022 (FAILED) would have established various requirements for the MDOT and the SHA related to pedestrian and bicycle rider safety, including (1) requirements for the planning, development, and implementation of certain elements and improvements; (2) mandated appropriations for SHA’s Safety, Congestion Relief, Highway, and Bridges System Preservation Minor Projects Program for fiscal 2024; and (3) a reporting requirement.

HB 1022 State Highway Administration – MD 5 Reconstruction Project at Great Mills (FAILED) would have required the Governor to appropriate the necessary funds in fiscal 2024 and 2025 for the construction of the MD 5 Reconstruction Project; the appropriations would have been required to be made in accordance with the Consolidated Transportation Program (CTP) for fiscal 2023 through 2028. The project would have been required to be constructed and commence operation by June 30, 2025. By December 1 of each year until completion of the project, the SHA would have been required to submit a report on the status of the project to specified committees of the General Assembly.

HB 1322 Operating Budget – Consolidated Transportation Program and Unanticipated Federal Funds (FAILED) would have required the financial forecast that supports the Consolidated Transportation Program (CTP) to include, for the summary of revenues and receipts component, a line item of $35 million for a reserve for changes in revenue sources for each fiscal year included in the forecast. In addition, the bill specified that, in fiscal 2022 and 2023, money authorized by the federal Infrastructure Investment and Jobs Act (IIJA) generally could not be expended by budget amendment unless the funds are to be used for specified purposes. Funds authorized by budget amendment in accordance with the bill would have had to be expended by June 30, 2023, and could not supplant existing funds. The bill’s restrictions did not apply to a federal fund budget amendment if the Board of Public Works (BPW) determines that the amendment is essential to maintaining the public safety, health, or welfare of the State or protecting the environment or economic welfare of the State. The bill’s provisions relating to expenditure of IIJA funds by budget amendment would have terminated June 30, 2023.

HB 1324 Transportation – Maryland Rail Authority – Establishment (Maryland Rail Investment Act of 2022) (FAILED) would have established the Maryland Rail Authority (MRA) and its various rights, duties, responsibilities, obligations, powers, and authorities. MRA would have been authorized to finance projects through the issuance of bonds (which are not considered State debt) for specified railroad facilities projects in the State (such as extended MARC services and the Southern Maryland Rapid Transit System). The bill would have established the Rail Authority Fund (RAF) to pay debt service for MRA; certain funds from the Transportation Authority Fund would have been required to be transferred to RAF. The bill would have required the MDTA to receive MRA’s consent before financing projects and issuing debt, as specified, and makes various other changes to MDTA’s operations.

ENVIRONMENTAL

Environmental Legislation ACEC/MD SUPPORTED that PASSED:

SB 14 Sustainable Maryland Program and Fund – Establishment (PASSED) creates the “Sustainable Maryland Program Fund” (SMPF), administered by the University of Maryland Environmental Finance Center (EFC), subject to specified requirements. The purpose of the fund is to expand and enhance Sustainable Maryland’s promotion and support of communities in the State in the effort to realize environmental, economic, and social sustainability. The Governor must include an appropriation of $750,000 annually to the SMPF beginning in fiscal 2024; this funding is supplemental to any funding that would otherwise be appropriated for the Sustainable Maryland program. The new fund will generally provide for additional outreach, education, and capacity building. There should be opportunities for ACEC/MD member firms to support these efforts through program support, general consulting, as well as project implementation.

SB 90 Department of the Environment – Supplemental Environmental Projects Database (PASSED) defines a “supplemental environmental project” (SEP) and requires the MDE to create and maintain a database of SEPs that MDE may consider for implementation as part of a settlement of an enforcement action. In creating and maintaining the database, MDE must solicit input from communities in the State that are overburdened, underserved, or otherwise disadvantaged by environmental stressors. The bill establishes limitations and considerations MDE must consider when choosing a SEP as part of a settlement of an enforcement action and before a violator undertakes a SEP. This should be a proactive approach to the way projects are lined up, allowing for quicker mitigation of violations and the like. We would expect this will provide some opportunity for our industry to develop sites for such a database and create future work opportunities, particularly those on the ‘full delivery’ side of the environmental restoration business. This will certainly benefit the proactive and may be detrimental to those who take a more passive approach to procuring design work. Overall, this legislation should be beneficial to the environmental design community by allowing for more efficient project development and delivery.

SB 630 Maryland Department of Emergency Management – Office of Resilience (PASSED) establishes the Office of Resilience in the Maryland Department of Emergency Management (MDEM). The bill requires the appointment of a Chief Resilience Officer (CRO) to coordinate State and local efforts to build resilience to risks identified in the Maryland Hazard Mitigation Plan and to develop a State Resilience Strategy. The bill also (1) specifies the duties and responsibilities of the office and (2) establishes that it is the intent of the General Assembly that State agencies and entities coordinate and cooperate with the office to carry out strategies and programs related to resilience. The bill establishes specific requirements for the University of Maryland Center for Environmental Science (UMCES) to coordinate with the CRO. This bill will help provide a more consistent approach across state and local agencies in addressing climate change and resiliency. It could also help ACEC/MD member firms to develop our clients’ needs so them the engineering community can better support these agencies in resiliency efforts.

Environmental Legislation ACEC/MD SUPPORTED that FAILED:

SB 366 & HB 921 Chesapeake and Atlantic Coastal Bays 2010 Trust Fund) (Chesapeake Bay Lockbox Protection Act of 2022) – Use of Funds (FAILED is would have introduced a constitutional amendment to establish a Chesapeake and Atlantic Coastal Bays 2010 Trust Fund to provide financial resources for certain nonpoint source pollution control projects in the State; and would have prohibited the transfer of funds in the Chesapeake and Atlantic Coastal Bays 2010 Trust Fund to the General Fund or a special fund of the State except under certain circumstances.

SB 674 & HB 1075 Natural Resources – State Lakes Protection and Restoration Fund – Funding and Sunset – Alterations (FAILED) would have repealed the June 30, 2022 termination date of Chapter 698 of 2018, which first established an annual mandated appropriation to the State Lakes Protection and Restoration Fund and made specified changes to provisions governing the fund. For fiscal 2024 and each fiscal year thereafter, the Governor would have been required to include in the annual budget bill an appropriation of $3.0 million to the fund.

Environmental Legislation ACEC/MD MONITORED that PASSED:

SB 348 & HB 653 Conservation Finance Act (PASSED) makes changes to a broad variety of existing programs related to environmental conservation and natural resources management and expands opportunities for agencies to obtain private investment and financing for State environmental projects, including conservation efforts, restoration projects, and the installation and repair of green and blue infrastructure. The bill also alters existing and establishes new State policies for several related programs and establishes a new workgroup, commission, task force, and review and reporting requirements. The primary agencies that are affected are the Maryland Department of Agriculture (MDA), the Maryland Department of the Environment (MDE), the Maryland Environmental Service (MES), and the Department of Natural Resources (DNR), but there are changes to procurement and contracting opportunities that affect additional agencies.

SB 464 & HB 350 Underground Facilities Damage Prevention – Enforcement (PASSED) is emergency legislation authorizing the Maryland Underground Facilities Damage Prevention Authority to impose additional punitive measures when a person fails to notify the one-call system before performing excavation or demolition in the State or violates any other requirement related to excavation and demolition. Specifically, instead of or in addition to assessing a civil penalty pursuant to current law, the authority may (1) require a person to participate in damage prevention training or implement procedures to mitigate the likelihood of damage to underground facilities or (2) impose other similar measures. In general, this may be a better approach than fines for violations, but the option for an Authority to implement a procedure to mitigate damage are vague and could lead to unexpected outcomes.

HB 318 Environment – On-Site Wastewater Services – Regulation (PASSED) establishes the State Board of On-Site Wastewater Professionals as a unit within the MDE to regulate and license individuals who provide on-site wastewater services in the State. MDE must adopt implementing regulations in consultation with the board by July 1, 2025. To support the board’s operations, the bill establishes the On-Site Wastewater Professionals Fund, funded primarily by fees, penalties, and fines collected under the bill. The bill also establishes (1) reporting requirements; (2) provisions governing license denials, revocations, and suspensions; and (3) penalties for violations. Finally, the bill repeals existing provisions related to the licensing of on-site wastewater property transfer inspectors. The bill generally takes effect July 1, 2022; the repeal of provisions related to the licensing of on-site wastewater property transfer inspectors takes effect June 30, 2025. Presumably, any licensing requirement associated with ‘design’ as defined above, would be superseded by a Professional Engineering license, though this is NOT explicitly stated.

SB 528 Climate Solutions Now Act of 2022 (PASSED) mandates broad changes to the State’s approach to reducing statewide greenhouse gas (GHG) emissions and addressing climate change. Among other things, the bill (1) increases the statewide GHG emissions reduction requirement and requires the State to achieve net-zero statewide GHG emissions by 2045; (2) establishes new and alters existing energy conservation requirements for buildings; (3) increases and extends specified energy efficiency and conservation program requirements; (4) establishes requirements for the purchase of zero-emission vehicles (ZEVs) in the State fleet; and (5) establishes new entities and new special funds to support related activities. The bill takes effect June 1, 2022; specified provisions terminate 6/60/2024, 12/31/2029 & 6/30/2030 Implementing the requirements of this bill will require the services of the engineering community in various capacities. There will be a need to design new and re-design existing buildings, utilities will need to find ways to provide additional electric power from wind and solar technology, electric vehicles will require extensive charging facilities, new transportation systems, etc.

HB 649 Environment – Discharge Permits – Inspections and Administrative Continuations (PASSED) requires the MDE to clear the backlog of administratively continued permits by December 31, 2026, as specified. The bill also establishes (1) inspection requirements for MDE with respect to certain facilities and sites operating under administratively continued permits and those in significant noncompliance, as specified, and (2) a reporting requirement and administrative penalty provisions for permittees operating in violation of specified laws and/or permit requirements. If MDE is afforded the resources needed to accomplish this task by the time required, it will affect many public and private entities who will require support from ACEC/MD member firms to comply with these inspections.

HB 869 Wetlands and Waterways Program Division – Permitting for Ecological Restoration Projects – Required Study (PASSED) requires the MDE’s Wetlands and Waterways Program Division, in consultation and coordination with specified entities, including the DNR, to conduct a comprehensive study, analysis, and evaluation of various items related to the permitting and completion of ecological restoration projects. The Wetlands and Waterways Program Division must develop legislative and regulatory recommendations based on the results of the study, analysis, and evaluation. The recommendations must address several specified topics. By June 1, 2024, MDE must report the findings and recommendations to the Governor and the General Assembly. This legislation could benefit restoration projects by providing separate review criteria and likely resulting in faster approvals.

HB 1200 Environment – Permit Applications – Environmental Justice Screening (PASSED) requires a person who is applying for a permit under § 1-601(a) of the Environment Article to include, as part of the permit application, the “EJ Score” from the “Maryland EJ tool” for the census tract where the applicant is seeking a permit, unless the permit requires the applicant to use a tool developed by the U.S. Environmental Protection Agency. In accordance with regulations adopted under the bill, the MMDE must review the EJ Score for the census tract where the applicant is seeking a permit using the Maryland EJ tool to verify the applicant’s information. The bill requires MDE to adopt implementing regulations. The bill also modifies public notice provisions applicable to certain permit applications to incorporate EJ Scores, as specified.

Environmental Legislation ACEC/MD MONITORED that FAILED:

HB 149 Wetlands and Waterways – Riparian Rights – Voluntary Registry and Notice (FAILED) would have required the MDE to establish and maintain a publicly available voluntary registry on its website of property owners who have registered a claim of riparian rights with MDE. MDE would have been required to determine the information that a property owner must submit to be included in the registry. The bill specifies that the holder of a covenant for riparian rights (including a community association) must be provided notice of a proposed project in the immediate area of the property that is subject to the covenant at the beginning of the State or local permitting or other approval process for the project. The bill also would have required the Governor tot appropriate funds to MDE to cover the cost of establishing and maintaining the registry.

HB 171 Climate Crisis and Environmental Justice Act (FAILED) would have established the Climate Crisis Initiative in the MDE and require the State to reduce greenhouse gas (GHG) emissions to (1) 60% of 2006 levels by 2030; (2) 100% of 2006 levels by 2040; and (3) be net-negative thereafter. As a funding source, the bill would have established various pollution fees on fossil fuels.

SB 221 & HB 402 Department of the Environment – Enforcement Authority (FAILED) would have updated, standardized, and expanded the authorized penalty and enforcement actions that could be taken to enforce several provisions of the Environment Article governing the appropriation or use of waters, reservoirs, and dams; nontidal wetlands; water pollution control; drinking water; water quality laboratories; waterworks and waste system operators; and wetlands and riparian rights. Generally, the bill would have authorized or augmented civil, administrative, and/or injunctive remedies. The bill would also have established new reporting requirements for drinking water and wastewater facilities and established a definition for “person.”

SB 267 & HB 85 Income Tax – Healthy Indoor Air Quality Tax Credit (FAILED) would have allowed certain persons to claim a 50% credit against the State income tax for certain qualified costs incurred during the taxable year to purchase and install certain indoor air quality equipment in a certain home, rental dwelling unit, or commercial building; and would have required the Comptroller, in consultation with the Maryland Energy Administration, to publish on the Comptroller’s website a list of approved indoor air quality equipment based on industry guidelines and best practices on or before September 30 each year; etc.

HB 363 Attorney General – Climate Change Actions – Authorization (FAILED) would have authorized the Attorney General to investigate, commence, and prosecute or defend any suit or action that holds accountable a publicly traded entity with a market capitalization greater than $1,000,000,000 or its subsidiaries for tortious or otherwise unlawful conduct that has contributed to climate change; and would have authorized the Attorney General to hire outside counsel on a contingency fee basis to assist with an action under the Act if the Attorney General made a determination that it is in the best interests of the State.

HB 365 Public School Construction – Fossil Fuel-Based Energy System Costs – Prohibition (FAILED) would have made fossil fuel-based energy system ineligible for State funding when it is part of a new or renovation school construction project. It also would have clarified that an evaluation of the life-cycle costs of public-school buildings required by current law would compare the costs of alternative energy systems with the costs of traditional fossil fuel-based systems. A “fossil fuel-based energy system” would have been defined as one that uses natural gas, petroleum, coal, or other fuel derived from these sources to create useful heat.

SB 471 & HB 729 Facilitating University Transformations by Unifying Reductions in Emissions (FUTURE) Act (FAILED) would have required each public four-year institution to be carbon neutral for “Scope 1 direct emissions” and “Scope 2 indirect emissions” by January 1, 2025, and for “Scope 3 indirect emissions” by January 1, 2035. Carbon neutrality could have been met through reduced carbon emissions or carbon offset projects, subject to specified requirements and restrictions. For carbon offsets used to meet the bill’s requirements, a public four-year institution would invest in the Environmental Justice Scholarship Program (to be administered by the Maryland Higher Education Commission (MHEC) an amount equal to the “social cost of carbon” minus the cost of the carbon offset. Each institution would have specified staff to implement the bill and dedicated to sustainability by specified dates.

SB 552 & HB 695 Environment – Climate Crisis Plan – Requirement (Better Together to Save Our Weather Act of 2022) (FAILED) would have required each county to prepare a climate crisis plan and submit it to the MDE for review by June 1, 2023. The bill would have established the minimum required contents of the plan as well as requirements for each county to follow in preparing its plan. MDE would have been required to provide feedback to each county by November 1, 2023, and each county would have been required to address the feedback and finalize its plan by January 1, 2024.

SB 575 & HB 783 Public Schools – Mold Assessment and Remediation (FAILED) would have required the State Department of Education, in consultation with the Maryland Department of Health and the Department of General Services, to adopt regulations on or before June 1, 2023, establishing uniform standards for mold assessment and remediation in public schools, including requiring each county board of education to establish a process for reporting and assessing potential mold in a public school and remediating mold identified during a mold assessment; etc.

HB 593 Department of Natural Resources – Oyster Shell Dredging – Permit Application (FAILED) emergency bill would have required the DDNR to apply, by July 1, 2022, to the MDE and the U.S. Army Corps of Engineers (USACE) for permits to dredge buried oyster shells on 27 specified oyster bars. Any shell removed from public oyster bottom under the bill would have been required to be relocated to public oyster bottom identified by the county oyster committees and the Oyster Recovery Partnership’s board of directors.

SB 783 & HB 596 Constitutional Amendment – Environmental Rights (FAILED) would have offered a constitutional amendment claiming that every person has the fundamental and inalienable right to a healthful and sustainable environment that may not be infringed. The State would have (1) served as the trustee of the State’s natural resources, including the air, land, water, wildlife, and ecosystems of the State and (2) conserved, protected, and enhanced the State’s natural resources for the benefit of every person, including present and future generations.

HB 708 Comprehensive Climate Solutions (FAILED) would have proposed broad changes to the State’s approach to reducing statewide greenhouse gas (GHG) emissions and addressing climate change. Among other things, the bill would have (1) called for increasing the statewide GHG emissions reduction requirement and requires the State to achieve net-zero statewide GHG emissions by 2045; (2) established requirements for monitoring methane emissions from landfills; (3) increased and extended specified energy efficiency and conservation program requirements; and (4) established new entities to support related activities.

SB 308 & HB 841 Environment – Statewide Green Business Certification Program (FAILED) would have required the MDE to establish and administer a statewide green business certification program. The certification program would (1) recognize businesses that operate in a manner that reduces their environmental footprint and (2) provide consumers with a way to identify businesses that have been certified as green businesses. MDE would also have been required to update and enhance the program established under the bill in consultation with the Montgomery County Green Business Certification Program.

SB 791 & HB 1031 Natural Resources – Land Conservation – Establishment of Goals and Programs (Maryland the Beautiful Act) (FAILED) would have established (1) land conservation goals for the State; (2) a Local Land Trust Revolving Loan Program administered by the Maryland Environmental Trust (MET); and (3) a Greenspace Equity Program administered by the DNR. The bill would also have established funding requirements for the programs and increases mandated funding for the Mel Noland Woodland Incentives and Fellowship Fund.

SB 854 & HB 1126 Graywater Systems – Public and Private Buildings – Authorization (FAILED) would have defined “graywater” and “graywater system” and authorized a graywater system to be used to serve a public or private building that (1) is located on a former dredge site or (2) is located in a remote area with minimal public access and operates on a seasonal basis An owner or operator of a building authorized to use a graywater system under the bill would have been required to safely dispose of the graywater in accordance with any guidelines or regulations adopted by the MDE, the Maryland Department of Health (MDH), or a federal agency.

SB 931 & HB 880 Environment – Impact of Actions on Climate, Labor, and Environmental Justice (FAILED) would have required a governmental unit, before taking an “action,” to evaluate and decide on whether and to what extent the action may negatively affect the climate, labor, and employment, “environmental justice,” and any “overburdened community.” The bill also would have defined an “action” as including the whole or a part of a rule, an order, a license, an approval, a denial sanction, or relief issued by a governmental unit.

HB 1033 Environment and Energy – Investment in Overburdened Communities (FAILED) would have required the MDE, by December 1, 2022, to develop policies and recommendations to require at least 40% of overall spending on specified programs, projects, and investments to benefit “overburdened communities.” Would have required State and local governmental units, in consultation with MDE, other specified State agencies, and the Commission on Environmental Justice and Sustainable Communities (CEJSC) , to the extent practicable, invest or direct available and relevant programmatic resources in a manner designed to achieve the investment to benefit overburdened communities. In addition, federal funds appropriated for specified programs and agencies (most of which relate to energy and energy efficiency) would have also been required to be prioritized to provide funding to overburdened communities. The bill also would have established related annual reporting requirements.

SB 588 & HB 1165 Capital Projects – High Performance and Green Buildings (FAILED) would have expanded the application of the State’s high-performance building requirement to any capital project (including major public school renovations) for which more than 25% of the funding for the acquisition, construction, or renovation of the project is State funds, subject to existing exemptions and waiver processes, and to more building renovation projects; newly constructed public schools and community college capital projects that receive any State funds are still required to be built as high-performance buildings. However, the bill would have allowed public schools and public safety buildings in sparsely populated areas to meet a lower high-performance building standard than other public buildings. The bill would have also altered the definition of a “major renovation” for the purpose of complying with the bill, reinstated a requirement that new public-school buildings obtain independent certification of their “green” status, and required the Maryland Green Building Council (MGBC) to ensure compliance with the bill’s requirements.

HB 1313 Environment – Exception to Nonstructural Shoreline Stabilization Requirements (FAILED) emergency bill that would have required a licensed marine contractor upon determining that an area (in tidal wetlands) is unsuitable for nonstructural shoreline stabilization measures, the area is exempt from (1) the requirement that improvements to protect a person’s property against erosion must consist of nonstructural shoreline stabilization measures that preserve the natural environment, such as marsh creation and (2) the waiver process that exempts a person from that requirement upon demonstrating to the Maryland Department of the Environment’s (MDE) satisfaction that nonstructural shoreline stabilization measures are not feasible for the person’s property.

HB 1372 Environment – Green Infrastructure Rebate Program – Establishment (FAILED) would have allowed for a Green Infrastructure Rebate Program, administered by the Maryland Department of the Environment (MDE) and participating counties with delegated authority, to provide rebates to eligible entities for “green infrastructure projects.” Among other things, the bill would have (1) established provisions relating to eligibility, rebate applications, and the issuance of rebates; (2) modified the authorized uses of the Maryland Clean Water Fund to include providing the State’s share of funding for rebates issued by MDE; and (3) established reporting requirements. MDE must adopt implementing regulations.

SB 999 & HB 936 Blue Ribbon Community Solar Land Use Commission (FAILED) would have created the Blue Ribbon Community Solar Land Use Commission that would have studied and made recommendations regarding the land use needs, the total number of megawatts of solar electricity needed, and the rate of rooftop solar panels compared to ground-mounted solar panels needed to meet the full generation capacity authorized under the Community Solar Energy Generating Systems Pilot Program; and would have required the Commission to report its findings and recommendations to the Governor and the General Assembly by December 1, 2022.

GENERAL BUSINESS

General Business ACEC/MD SUPPORTED that PASSED:

SB 9 Procurement – Minority Business Enterprises – Study (PASSED) requires the MDOT to study options for streamlining the certification process for minority business enterprises (MBEs). It also requires specified State entities to provide, within 60 days, information requested by MDOT to assess the need for remedial measures. Each entity must require licensees, preapproved licensees, applicants, grantees, and other program participants to provide any information deemed necessary within 60 days of the request. A business can qualify as an MBE without the requirement to file any additional paperwork other than certification under the Federal Disadvantaged Business Enterprise Program.

SB 250 & HB 325 State Procurement – Payment Practices (PASSED) makes interest on unpaid invoices under State procurement contracts due and payable after 30 days (instead of 45 days) from when the agency receives an invoice. It requires the Department of Legislative Services (DLS) to conduct a study and report on the processing and timing of payments to contractors under State procurement contracts. It also requires the Department of Information Technology (DoIT) to consult with specified agencies and report on the status of the Comptroller’s online payment portal and the planned upgrade to the State’s Financial Management Information System (FMIS) and related issues. The bill expresses legislative intent that any upgrade to FMIS include goals to significantly reduce the amount of time in which payments are processed. The bill generally takes effect July 1, 2022, but the provision related to the accrual and payment of interest on unpaid invoices takes effect June 1, 2023.

SB 723 & HB 791 Sales and Use Tax – Digital Product – Definition (PASSED) alters the definition of digital product for purposes of the State sales and use tax and specifies that the following are not digital products: (1) a product having electrical, digital, magnetic, wireless, optical, electromagnetic, or similar capabilities where the purchaser holds a copyright or other intellectual property interest in the product, in whole or in part, if the purchaser uses the product solely for commercial purposes, including advertising or other marketing activities; and (2) computer software or software as a service purchased or licensed solely for commercial purposes in an enterprise computer system, including operating programs or application software for the exclusive use of the enterprise software system, that is housed or maintained by the purchaser or on a cloud server, whether hosted by the purchaser, the software vendor, or a third party.

SB 314 & HB 999 Maryland Energy Administration – Mechanical Insulation Installation Grant Program (PASSED) creates a credit against the State income tax for up to 30% of the allowable costs incurred to install mechanical insulation on a commercial or industrial building. The Maryland Energy Administration (MEA) is required to administer the credit and may award a maximum of $1 million in credits in each tax year. The bill takes effect July 1, 2022and applies to tax years 2022 through 2026.

HB 399 Washington Suburban Sanitary Commission – Minority Business Enterprise Utilization Program – Termination Extension PG/MC 105-22 (PASSED) extends from July 1, 2022, to July 1, 2023, the authorization of the Washington Suburban Sanitary Commission’s (WSSC) minority business enterprise (MBE) utilization program.

General Business legislation ACEC/MD SUPPORTED that FAILED:

SB 161 & HB 79 Courts – Prohibited Indemnity and Defense Liability Agreements (FAILED) would have expanded the prohibitions in § 5-401(a) of the Courts and Judicial Proceedings Article by prohibiting a contract or agreement with a “design professional” for “professional services” from including (1) specified indemnification or hold harmless clauses and (2) specified provisions requiring a design professional to defend parties against liability or certain claims unless the design professional was the proximate cause of the injury or loss. Requested by ACEC/MD

SB 491 Property Tax – Taxation of Business Property – Tax Rates, Exemptions, and Credits (FAILED) if enacted this legislative proposal would have allowed businesses such as ACEC/MD members to limit their personal property tax for county and municipal government to $2.00 per $100 of assessment and qualify for a grant a property tax credit up to 80% of personal property taxes paid county and municipal government in fiscal 2019 through fiscal 2022. The credit may only be claimed for a single taxable year.

HB 552 State Finance and Procurement – Retention Proceeds (FAILED) would have required the undisputed retention proceeds on State construction contracts that are retained by a state agency or a contractor to be paid within 90 days after the substantial completion of a project, as defined by the applicable contract or subcontract.

HB 772 Corporations and Associations – Annual Reports – Filing Fees (FAILED) would have exempted business entities from paying the filing fee required with the submission of an annual report to the State Department of Assessments and Taxation (SDAT) if: (1) the annual report is filed electronically; or (2) the business entity does not report any personal property for which property tax is owed.

HB 1284 Income Tax – Credit for Cybersecurity Measures Undertaken by Small Businesses (FAILED) would have created a refundable credit against the State income tax for certain cybersecurity expenses incurred by a small business.

HB 1353 Omnibus Procurement Reform Act (“OPRA”) of 2022 (FAILED) would have made the purposes and policies of State procurement law apply to county procurements that include any State funds, and it given the Maryland State Board of Contract Appeals (MSBCA) jurisdiction to hear and decide appeals related to those local procurements. It would also have made various changes to State procurement policies and procedures related to the cancellation of solicitations, the timelines for MSBCA rulings, disclosure of information regarding awarded contracts, and costs of contract claims and bid protests that may be awarded to successful appellants.

General Business legislation ACEC/MD OPPOSED that PASSED:

SB 487 & HB 389 Procurement – Minority Business Enterprises – Revisions (PASSED) establishes the position of Minority Business Enterprise (MBE) Ombudsman within the Governor’s Office of Small, Minority, and Women Business Affairs (GOSBA); expands accountability, transparency, and training requirements for the MBE program; codifies an existing set-aside program for small businesses; and requires a follow-up report to assess implementation of the bill’s provisions.

General Business legislation ACEC/MD OPPOSED that FAILED

HB 913 Calvert County – Procurement – Local Preference (FAILED) would have authorized the Board of County Commissioners of Calvert County to enact an ordinance that gives a percentage preference to a resident business that submits a responsive bid or offer that exceeds the lowest responsive bid or offer by a nonresident business. With the preference, if the bid or offer by the resident business exceeds the bid or offer of the nonresident business by less than a specified percentage, the resident bidder or offeror may be awarded the contract. “Resident business” means a business whose principal office, as defined, is in Calvert County. The bill also would have defined a “nonresident business” to mean a business whose principal office is outside the county.

General Business ACEC/MD MONITORED that PASSED:

SB 310 & HB 386 Anne Arundel County and City of Annapolis – Small, Minority, and Women-Owned Businesses Account – Local State of Emergency (PASSED) expands the eligible uses of the Small, Minority, and Women-Owned Businesses Account (SMWOBA) to include grants to businesses and nonprofit organizations in Anne Arundel County and the City of Annapolis when in a local state of emergency as declared by the principal executive officer. The bill also establishes a Workgroup to Study the Establishment of a State Disaster Relief Fund, staffed by the Maryland Department of Emergency Management (MDEM). The workgroup must study and report its recommendations regarding the efficacy and sustainability of existing emergency fund sources and the potential establishment of a State Disaster Relief Fund.

HB 342 Corporations and Associations – Limited Liability Companies and Partnerships – Operating Agreements and Partnership Agreements (PASSED) specifies that operating agreements and partnership agreements may provide for interests in limited liability companies (LLCs) and partnerships to be transferred or assigned to other persons, including to non-members/non-partners. The bill further specifies that transfers on death, pursuant to the terms of an LLC operating agreement or a partnership agreement of a general or limited partnership, are effective according to the agreement and are not to be considered testamentary. The bill applies to all LLC operating agreements, general partnership agreements, and limited partnership agreements in effect upon the bill’s effective date.

SB 507 Procurement – Construction Contracts – Contract Modification – Report (PASSED) requires the Secretary of Transportation and the Secretary of General Services, by December 1, 2022, to each report to the General Assembly on (1) the number and percentage of State construction procurements using a fixed-price contract with price adjustment and (2) for price adjustments executed under those contracts, the material types affected and the average price adjustment for each material type. The reports must include data from fiscal 2019 through 2021. The bill takes effect July 1, 2022 and terminates June 30, 2023.

SB 644 Department of General Services – Study on Procurement Preferences for Businesses in Historically Underutilized Business Zones (PASSED) requires the Department of General Services (DGS), in consultation with the Governor’s Office of Small, Minority, and Women Business Affairs, to study the feasibility and impacts of establishing a State procurement percentage preference for businesses located in historically underutilized business zones (HUB Zones). By December 1, 2022, DGS must report its findings and recommendations to the General Assembly. The bill takes effect June 1, 2022 and terminates May 31, 2023.

HB 1451 Housing and Community Development – Business Projects and the Business Development Program – Financial Assistance (PASSED) authorizes the Community Development Administration (CDA) within the Department of Housing and Community Development (DHCD) to provide specified forms of financial assistance for business projects, including a convertible promissory note, as specified. The bill also authorizes DHCD to provide financial assistance under the Neighborhood Business Development Program as a convertible promissory note, as specified. The bill takes effect July 1, 2022; the bill’s authorization to provide convertible promissory notes as a form of financial assistance for business projects terminates July 1, 2026.

General Business ACEC/MD MONITORED that FAILED:

SB 107 & HB 5 State Government – State and Local Government Employees and Contractors – Cybersecurity Training (FAILED) would have applied existing requirements related to the protection of personal information to the Legislative and Judicial branches of State government. The bill also would have required the Maryland Cybersecurity Coordinating Council (MCCC) to develop a Cybersecurity Awareness and Training Program to certify training programs, [by date certain] State and local employees must complete a certified cybersecurity training at least four times per year and certain government contractors would have been required to receive training as well. MCCC would have been required to develop standards for the program and trainings.

HB 13 Procurement – Discriminatory Hiring Practices – Debarment(FAILED) would have made a person eligible for debarment from entering into a contract with the State if the person or other specified individual associated with the person (1) has been found to have violated Title 20, Subtitle 6 of the State Government Article, which generally prohibits employment discrimination, or (2) has been debarred from federal contracts under federal Executive Order 11246 due to engaging in discriminatory hiring practices in the State.

HB 182 State Procurement – Certification of LGBTQ Businesses (FAILED) would have required the MDOT, by December 1, 2022, and annually thereafter, to compile and manage a list of certified lesbian, gay, bisexual, transgender, or queer (LGBTQ) businesses in the State,to identify and encourage outreach to LGBTQ businesses and to track their participation in State contracts.

SB 360 Corporate Tax Fairness Act of 2022 (FAILED) would have altered (1) the distribution of corporate income tax revenues; (2) required affiliated corporations to compute Maryland taxable income using combined reporting; and (3) applied a “throwback” rule in determining whether sales are considered in the State for purposes of the State’s corporate income tax apportionment formula.

SB 361 Income Tax – Carried Interest – Additional Tax (FAILED) would have imposed a 17% State income tax on the distributive share or pro rata share of a pass-through entity’s (PTE) taxable income that is attributable to investment management services provided in the State. Would have required the Comptroller to notify the Department of Legislative Services (DLS) within five days after determining that federal legislation with an identical effect has been signed into law.

SB 399 & HB 416 State Government – Quasi-Governmental Units – Oversight and Governance (FAILED) would have defined specified entities as “quasi-governmental units” and established various requirements relating to quasi-governmental units. Among other things, the bill would have required the board of directors of each quasi-governmental unit to obtain an independent assessment of the board’s operations by December 31, 2023, and every five years thereafter. A quasi-governmental unit would have been required to annually submit a full and detailed budget to the Department of Budget and Management (DBM) for inclusion in the annual budget books for informational purposes, and the budget committees of the General Assembly would have been required to hold a hearing on the budget of each quasi-governmental unit at least once every two years. The Department of Legislative Services (DLS) would have been required to conduct an evaluation of each quasi-governmental unit at least once every eight years, as specified. Finally, the bill would have established the intent of the General Assembly that specified factors should be weighed when considering the creation of a new quasi-governmental unit.

HB 457 Corporate Income Tax – Throwback Rule and Combined Reporting (FAILED) would have (1) applied a “throwback” rule in determining whether sales are considered in the State for purposes of the State’s corporate income tax apportionment formula; (2) required affiliated corporations to compute Maryland taxable income using combined reporting; and (3) created a subtraction modification against the State income tax for certain deferred tax liabilities and assets.

SB 553 & HB 552 State Finance and Procurement – Retention Proceeds (FAILED) would have required that undisputed retention proceeds on State construction contracts that are retained by a State agency or a contractor be paid within 90 days after the substantial completion of a project, as defined by the applicable contract or subcontract.

SB 555 & HB 292 Occupational Licensing Boards and Commission on Judicial Disabilities – Reporting Disciplinary Activities (FAILED) would have required each business and health occupations board to include information on the gender, race, county of practice, type of disciplinary action imposed, length of disciplinary period, and amount of any fine imposed in any annual report on disciplinary activity issued by the board. By September 1 each year, the Commission on Judicial Disabilities would have been required to submit to the Governor and the General Assembly, a report on its disciplinary activities, including the above specified information for each judge disciplined.

SB 782 & HB 1424 Workgroup on the Post-COVID-19 Crisis Economic Transition (FAILED) would have established a Workgroup on the Post-COVID-19 Crisis Economic Transition, staffed by the Department of Legislative Services (DLS), to make recommendations regarding how the State may adjust its economic development and other strategies in the context of changes resulting from crises in sectors, as specified. The workgroup would have been required to retain the services of the University of Maryland, and $500,000 would be appropriated for that purpose.

HB 1450 Blueprint for Maryland’s Future – Implementation Plans and Funds – Alterations (FAILED) would have altered the distribution of certain sales and use tax revenues to the Blueprint for Maryland’s Future Fund (BMFF). By June 2023, the Comptroller would have been required to distribute $800 million in income tax revenues to BMFF. For fiscal 2023, a county government would have been required to appropriate the greater of the local share of major education aid (accounting for relief provisions) and a specified maintenance of effort (MOE) for each county. The bill also would have altered the dates by which (1) the Accountability and Implementation Board (AIB) must adopt a Comprehensive Implementation Plan (CIP) for the Blueprint for Maryland’s Future (Blueprint); (2) the Maryland State Department of Education (MSDE) must develop criteria for approval or disapproval of related local implementation plans; and (3) State and local government units must submit those implementation plans.

WORKPLACE & HEALTH

Workplace-Health bills that ACEC/MD SUPPORTED that FAILED

SB 827 Unemployment Insurance – Computation of Earned Rate of Contribution – Applicable Table of Rates (FAILED) would have required that unemployment insurance (UI) tax [rate] Table B be applied for calendar 2023 instead of [rate] Table C if, on September 30, 2022, the Unemployment Insurance Fund Balance would normally allow either [rate] Table A or Table B to apply.

Workplace-Health bills that ACEC/MD OPPOSED That FAILED

SB 433 & HB501 Labor and Employment – Workers’ Compensation Claims – Fees for Legal Services (FAILED) would have authorized the Workers’ Compensation Commission (WCC) to order a fee of up to $2,000 be paid for legal services rendered on behalf of a covered employee if no compensation, other than a medical benefit, is payable to the covered employee. WCC would have been authorized to order the fee to be paid by (1) the covered employee; (2) the employer or its insurer; (3) a self-insured employer; or (4) the Uninsured Employers’ Fund (UEF).

Workplace-Health bills that ACEC/MD MONITORED that PASSED

HB 496 Labor and Employment – Family and Medical Leave Insurance Program – Establishment (Time to Care Act 2022) (PASSED) establishes a Commission on the Establishment of a Family Medical Leave and Insurance (FMLI) Program, jointly staffed by the Maryland Department of Labor (MDL) and the Department of Legislative Services (DLS), to study and make recommendations for establishing a FMLI program in the State. The bill expresses legislative intent that $25.0 million be set aside in the fiscal 2023 budget to support the work of the commission and for MDL to prepare to implement a FMLI program. The bill further expresses legislative intent that the statutory framework establishing a FMLI program in the State be effective no later than June 1, 2023, with individuals eligible to receive FMLI benefits by June 1, 2024.

SB 275 Labor and Employment – Family and Medical Leave Insurance Program – Establishment (Time to Care Act of 2022) (PASSED) establishes the Family and Medical Leave Insurance (FAMLI) Program and FAMLI Fund to provide up to 12 weeks of benefits to a covered individual taking leave from employment due to specified personal and family circumstances. The weekly benefit is based on the individual’s average weekly wage, subject to a cap. The FAMLI Fund consists of contributions from employees and employers of at least 15 employees and pays for benefits, a public education program, and implementation and administrative costs.

HB 78 Discrimination in Employment – Reasonable Accommodations for Applicants with Disabilities (PASSED) prohibits an employer from failing or refusing to make a reasonable accommodation for the known disability of an applicant for employment. An employer is not required to reasonably accommodate the disability of an applicant if the accommodation would cause undue hardship on the conduct of the employer’s business.

SB 450 Harassment and Sexual Harassment – Definitions – Employment Discrimination and Sexual Harassment Prevention Training (PASSED) alters the statutory definition of “harassment” relating to employment discrimination. The bill explicitly includes sexual harassment within the definition of harassment and expands the definition of harassment to include conduct under certain circumstances, as specified, which need not be severe or pervasive. The bill also alters the definition of “sexual harassment” in statutory provisions relating to the requirement that each State employee, as specified, complete mandatory sexual harassment prevention training.

SB 450 Unlawful Employment Practice – Statute of Limitations – Tolling (PASSED) establishes that the timing limitations within which a person may file a civil action in circuit court alleging an unlawful employment practice (i.e., within two years after the alleged unlawful employment practice occurred, or within three years for a harassment allegation) are tolled while an administrative charge or complaint is pending.

SB 655 & HB 253 Unemployment Insurance – Federal Extended Benefits for Long-Term Unemployment (PASSED) establishes an additional “on” indicator to determine if unemployment insurance (UI) claimants are eligible to receive federally funded extended benefits (EB), based on the average total unemployment rate (TUR) in the State. The additional on indicator applies for weeks of unemployment (1) beginning after June 1, 2022, when 100% federal sharing is available and (2) ending four weeks before the last week for which 100% federal sharing is available. Generally, after the on indicator occurs, an “off” indicator (which ends EB) exists in a week when none of the above circumstances applies for that week and the 12 immediately preceding weeks. The bill also authorizes the Secretary of Labor to suspend the payment of EB under specified circumstances.

SB 591 Maryland Health Care Commission – Patient Safety Center – Designation and Fund (PASSED) requires the Maryland Health Care Commission (MHCC) to designate a Patient Safety Center for the State by a 12/31/2022 and establish a Patient Safety Center Fund to subsidize a portion of the costs of the center. For fiscal 2023 and each fiscal year thereafter, the Governor must include in the annual budget bill an appropriation of $1.0 million for the fund. MHCC may provide a grant (from the fund) to the center. By October 1 each year, MHCC, in conjunction with the center, must report to specified committees of the General Assembly on the center’s statewide activities and how the center’s initiatives align with State-designated priorities.

Workplace-Health bills that ACEC/MD MONITORED that FAILED

SB 10 Workers’ Compensation – COVID-19 Occupational Disease Presumption (FAILED) would have established an occupational disease presumption for a first responder or public safety employee or a health care worker, as defined by the bill, who tests positive for or is diagnosed with COVID-19 under specified circumstances. The bill would have applied retroactively and applied to and interpreted to affect workers’ compensation claims filed on or after March 1, 2020.

SB 66 (FAILED) would have prohibited an employer from (1) developing or implementing an application (or a hiring process) that uses a GED, high school diploma, or college or other higher education degree as a limitation for who can apply for a specified position; (2) using an applicant’s lack of a GED, high school diploma, or college or other higher education degree to deny an applicant the opportunity to apply for a position; (3) prohibiting an employee from applying for (or pursuing) internal advancement within the employer’s organization on the basis of an employee lacking a GED, high school diploma, or college or other higher degree; or (4) inquiring about an applicant’s lack of a GED, high school diploma, or college or other higher education degree during the interview process. Nevertheless, an employer would have been allowed take such actions if a minimum educational qualification is necessary to obtain specified occupational or health licenses.

SB 224 & HB 299 Labor and Employment – Employment Standards and Conditions – Definition of Employer (FAILED) would have added a standardized definition of “employer” to State laws that pertain to employment standards and conditions. The general definition of “employer” would mean “a person engaged in a business, industry, profession, trade, or other enterprise in the State that employs an individual in the State.” The definition would also include a person who “acts directly or indirectly in the interest of another employer with an employee.”

SB 374 & HB 439 Workers’ Compensation – Occupational Disease Presumptions – 9-1-1 Specialists (FAILED) would have established a workers’ compensation occupational disease presumption for 9-1-1 specialists (as defined in the Public Safety Article) who are diagnosed with post-traumatic stress disorder (PTSD) by a licensed psychologist or psychiatrist.

SB 449 Unlawful Employment Practices – Remedies (FAILED) would have increased the limitations on the amount of compensatory and punitive damages that may be awarded to a plaintiff in cases of unlawful employment practices. The bill also would have increased, from two years to three years, the amount of back pay that may be awarded in such a case.

SB 493 & HB 610 Public Health – Commission on Universal Health Care (FAILED) would have established the Commission on Universal Health Care that would develop a plan for the State to establish a universal health care program to provide health benefits to all residents of the State through a single-payer system.

SB 621 & HB 675 Health Insurance – Changes to Coverage, Benefits, and Drug Formularies – Timing (FAILED) would have prohibited an insurer, nonprofit health service plan, or health maintenance organization (collectively known as carriers) from changing the coverage of services or benefits provided under a health insurance policy or contract during the term of the policy or contract.

MECHANICAL & ELECTRICAL

Mechanical & Electrical bills that ACEC/MD MONITORED that FAILED

HB 43 Department of General Services – Energy–Conserving Standards (Maryland Sustainable Buildings Act of 2022) (FAILED) would have required the Department of General Services (DGS) to (1) establish standards for State buildings to conserve energy and minimize adverse impacts on birds, as specified and (2) update the standards every five years.

HB 61 Charter Counties – Enforcement of Local Building Performance Laws (Building Energy Performance Standards Act of 2022) (FAILED) would have authorized charter counties to impose civil fines up to $10 per square foot of gross floor area to enforce local building energy performance laws. A charter county would be allowed to consider the assessed value of a property in determining the civil fine imposed under the bill. The bill would have defined gross floor area as the total indoor property square footage measured between the principal exterior surfaces of the enclosing fixed walls of a building.

HB 257 Residential Elevators – Inspections (FAILED) would have required an elevator installed in a privately owned single-family residence register with the Commissioner of Labor and Industry and meet other specified related requirements, subject to existing penalty provisions. Each such elevator would be inspected upon installation or change in ownership. Inspection costs and modifications required to pass an inspection would be the responsibility of the residential elevator owner. An inspection would be made by an elevator inspection company that (1) is registered with the State; (2) maintains a minimum $150,000 elevator inspector general liability insurance policy; and (3) did not install the elevator being inspected. An elevator installed in a residential dwelling before January 1, 2023, would have been exempted from a “hoistway” gate distance requirement; however, a life screen barrier added to a residential elevator would be required to be installed by a certified elevator contractor.

HB 806 Building Standards and Emissions Reductions – High Performance, State, and Local Government Buildings, State Operations, and Eligible Projects (FAILED) would have made substantial changes to the way the State and local government construct and maintain buildings to reduce greenhouse gas (GHG) emissions and enhance the environmental friendliness of State and local buildings. Broadly, it (1) would have modified the types of buildings that qualify as “high-performance buildings; (2) required the Department of General Services (DGS) to establish standards for the purchase of environmentally friendly construction materials and to implement the standards for the construction or renovation of State buildings; and (3) required “covered” State and local government buildings to comply with an all-electric construction code and specified GHG emissions standards.

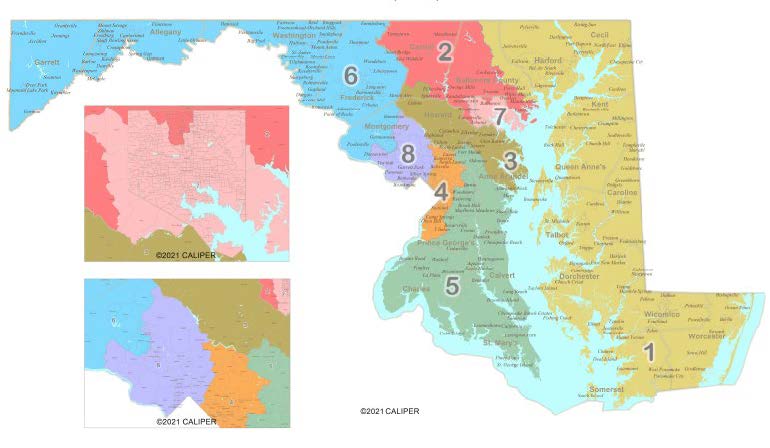

CONGRESSIONAL REDISTRICTING

Congressional district boundaries must be redrawn every 10 years following the decennial census to adjust for population changes.

In 2022, the Circuit Court for Anne Arundel County considered two consolidated cases (Szeliga et. al v. Lamone et. al and Parrott et. al v. Lamone et. al) challenging the 2021 congressional districting plan. On March 25, 2022, the circuit court entered a declaratory judgment ruling that the 2021 congressional districting plan violates the Maryland Constitution and Declaration of Rights and issued a permanent injunction enjoining the State from using, applying, administering, enforcing, or implementing the 2021 plan in any future election in Maryland, including the 2022 primary and general elections. While the Maryland Constitution does not explicitly address congressional districting, the circuit court held that Article III, Section 4 of the Maryland Constitution, which establishes standards for legislative districts in the State, applies to congressional districting. Article III, Section 4 of the Maryland Constitution requires each legislative district to consist of adjoining territory, be compact in form, and be of substantially equal population.

The circuit court remanded the plan to the General Assembly to develop a new plan that comports with Article III, Section 4 of the Maryland Constitution and the Voting Rights Act by March 30, 2022. In response to this mandate, the General Assembly passed a new map in Senate Bill 1012 (Ch. 16), which the Governor signed into law on April 4, 2022. The State subsequently dropped its appeal of the circuit court’s decision, which means that the new map will be used in 2022 and subsequent elections.

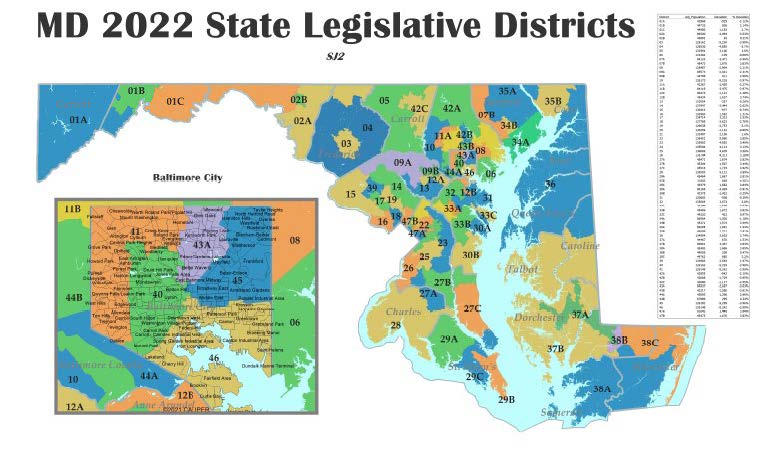

LEGISLATIVE REDISTRICTING

The boundaries of the State’s 47 legislative districts must be redrawn every 10 years following the decennial census to adjust for population changes. Legislative districts must comply with the U.S. Constitution, the Maryland Constitution, and the federal Voting Rights Act of 1965. Pursuant to Article III, Section 4 of the Maryland Constitution, each legislative district must consist of adjoining territory, be compact in form, and be of substantially equal population, and due regard must be given to natural boundaries and the boundaries of political subdivisions.